accumulated earnings tax c corporation

An IRS review of a business can impose it. C corporations can earn up to 250000 without incurring accumulated earning tax.

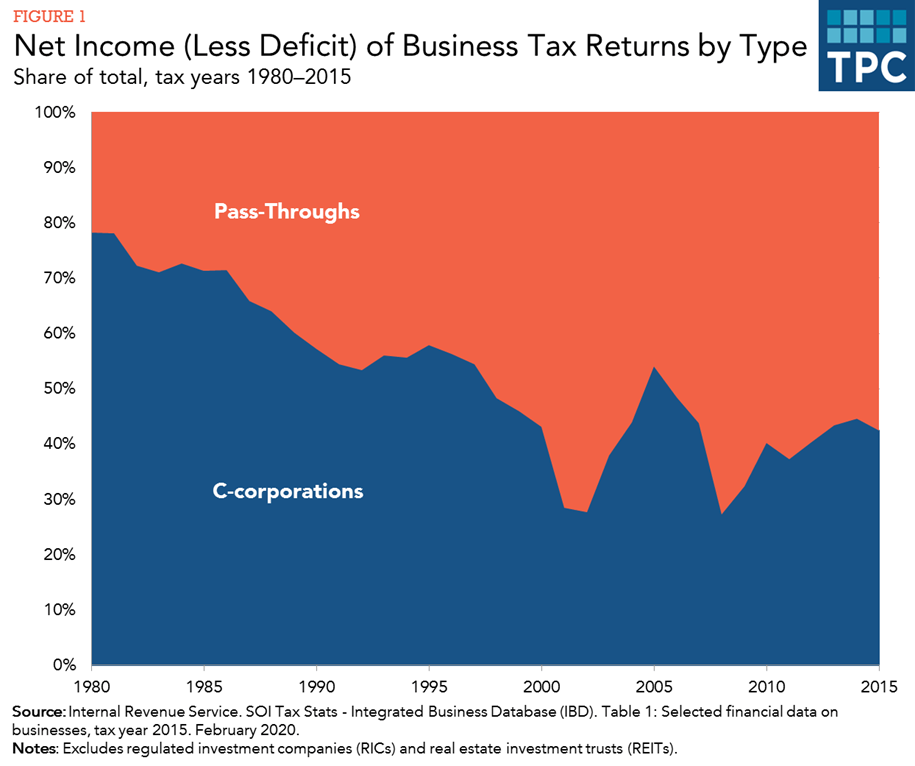

S Corp Rias Disadvantaged By The Tax Bill Mercer Capital

IRC 1368 c 1.

. The characterization of the distribution is governed by Section 1368 c. Furthermore you can find the Troubleshooting Login Issues section which can answer your. REASONABLE NEEDS OF THE BUSINESS.

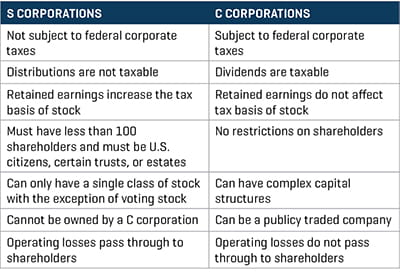

It is presumed that a corporation can retain up to 25000000 or 15000000 for certain service corporations for. C corporations may accumulate earnings up to 250000 without incurring an accumulated earnings tax. The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b formed or availed of for the purpose of avoiding the income tax with respect to its shareholders or the shareholders of any other corporation by permitting earnings and profits to accumulate instead of being divided or distributed.

If imposed the earnings are subject to triple taxation when eventually. If a C corporation retains earnings above a certain amount the corporation may be assessed a tax penalty called the accumulated. Its purpose is to prevent the accumulation of earnings if the reason for such is for shareholders to avoid paying taxes by not paying dividends.

Filed its 1995 tax return showing a liability of 2674 which it paid in March 1996. If the distribution does not exceed the AAA the distribution is treated as if made by an S corporation with no accumulated. Insights into todays critical tax issues to help you turn disruption into opportunity.

Accumulated Earnings Tax S Corporation will sometimes glitch and take you a long time to try different solutions. May 17th 2021. The accumulated earnings tax imposed by section 531 does not apply to a personal holding company as defined in section 542 to a foreign personal holding company as defined in section 552 or to a corporation exempt from tax under subchapter F chapter 1 of.

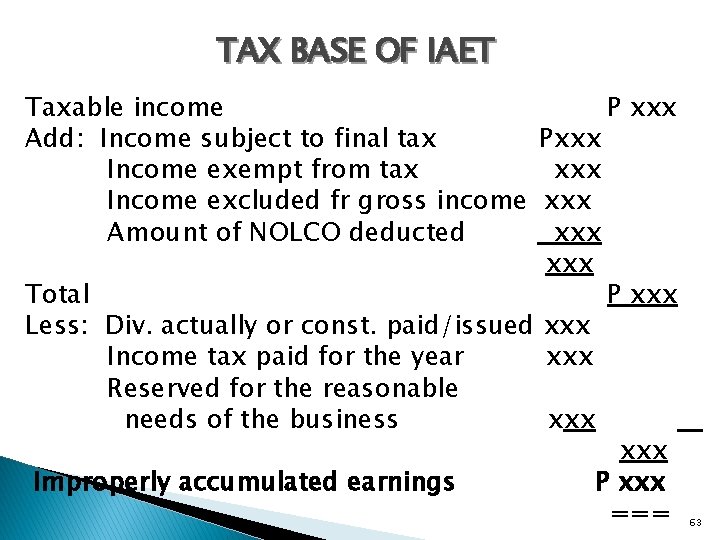

Furthermore you can find the Troubleshooting Login Issues section which can answer your unresolved problems and equip you. There is no IRS form for reporting the AET. Our system imposes a 20 percent tax on accumulated taxable income of a corporation availed of to avoid tax to shareholders by permitting earnings and profits to accumulate rather than being paid out.

If a corporation pursues an earnings accumulation strategy where the accumulation is to avoid the tax on dividends rather than having a business purpose then IRC 532 provides an accumulated earnings tax that can be assessed on accumulated earnings with no clear business purpose. Accumulated Earnings Tax. LoginAsk is here to help you access Accumulated Earnings Tax quickly and handle each specific case you encounter.

For C corporations the current accumulated retained earnings threshold that triggers this tax is 250000. The IRS audited Metros return and after modifying the companys deductions for officers salaries determined it had not paid enough tax. The accumulated earnings tax is considered a penalty tax to those C corporations that have accumulated over 250000 in earnings 150000 for PSC corporations and if that excess amount has not been distributed to shareholders in the form of a dividend.

If a corporation accumulates earnings that exceed the exemption amounts an accumulated earnings tax of 20 15. How the accumulated earnings tax interacts with basic C corporation planning Choice-of-entity planning involving C corporations often revolves around a plan to operate a business through a C corporation to take advantage of the low 21 federal corporate income tax rate retain earnings in the corporation by minimizing compensation and dividends. Accumulated Earnings Tax will sometimes glitch and take you a long time to try different solutions.

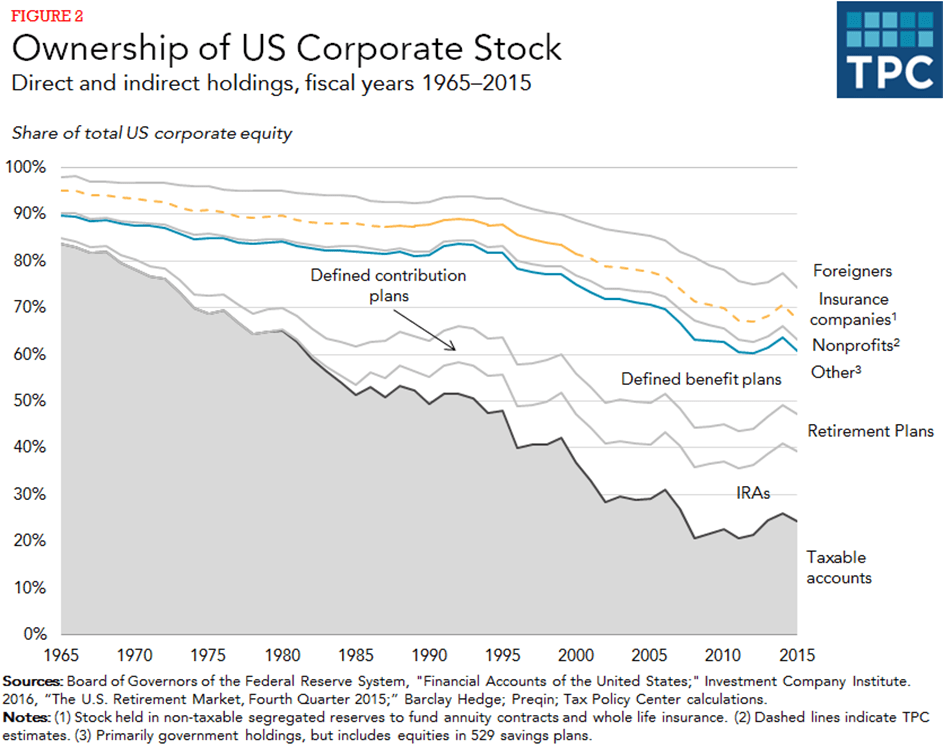

If an S corporation has accumulated EP tax-free distributions generally can be made to the extent of the corporations AAA. This decreases government tax revenues because shareholders are unlikely to sell their valuable. Tax Rate and Interest.

If the deemed dividend election is made for all the EP on the 2010 Form 1120S which is due to be filed in 2011 the shareholder will have a basis of 10000 and so. In this article Cory Stigile provides background on the accumulated earnings tax and explains the steps corporate taxpayers may be able to take if the government begins to more actively audit and litigate the accumulation of profits. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends with the purpose of avoiding shareholder - level tax seeSec.

Get powerful editing tools and integrated no-code Bots. Metro Leasing and Development Corp. Ad Сomplete forms right in a browser.

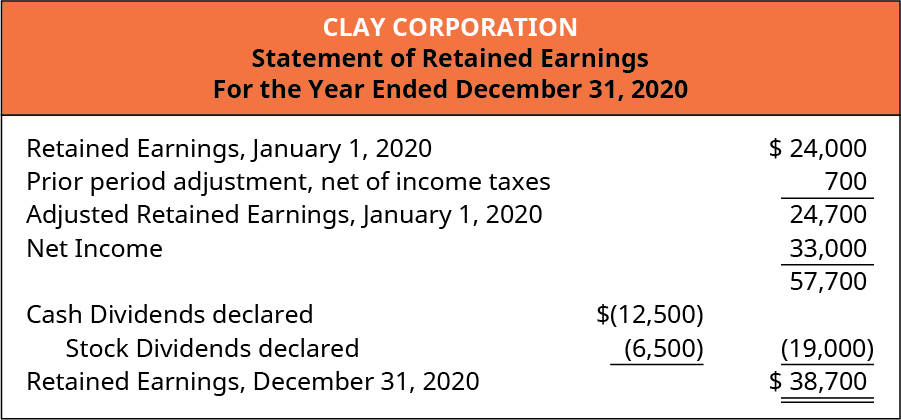

Enjoy airSlates all-in-one business process automation solution available on any device. Calculation of Accumulated Earnings. The tax is in addition to the regular corporate income tax and is assessed by the IRS typically during an IRS audit.

Ad Discover Why We Have Been Chosen for Business Incorporation for 40 Years. A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons. Traded stock IRC section 532c.

The AET is imposed in addition to the regular corporate income tax. The accumulated earnings tax is computed on the corporations accumulated taxable income for the taxable year or years in question. In periods where corporate tax rates were significantly lower than individual tax rates an obvious.

Accumulated Earnings Tax is a corporate-level tax assessed by the IRS. Receive Personal Attention From a Knowledgeable Business Incorporation Expert. The tax rate is 20 of accumulated taxable in-come defined as taxable income with adjustments including the subtraction of federal and foreign income taxes.

Ad Get Grant Thornton Tax Services articles podcasts webcasts surveys reports and more. The accumulated earnings tax is equal to 20 of the accumulated taxable income and is imposed in addition to other taxes required under the Internal Revenue Code. NEW Corp is an S corporation that has subchapter C accumulated earnings and profits of 20000 on December 31 2019 the day it converted to an S corporation.

The corporation has an ordinary operating loss of 15000 for its 2010 tax year. This is because corporations that do not spend retained earnings are generally more valuable than those without accumulated retained earnings. Publicly held corporations with many.

The Tax Cuts and Jobs Act reduced the corporate tax rate from 35 percent to 21 percent providing Read More. In 2020 the corporation made a net. However if a corporation allows earnings to accumulate beyond the reasonable needs of the business it may be subject to an accumulated earnings tax of 20.

A corporation may be allowed an accumulated earnings credit in the na-. The risk of incurring such tax is usually associated with the closely-held company but there is per. The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed.

LoginAsk is here to help you access Accumulated Earnings Tax S Corporation quickly and handle each specific case you encounter. It also found Metro was subject to the accumulated earnings penalty tax. A personal service corporation PSC may accumulate earnings up to 150000 without having to pay this tax.

The accumulated earnings tax is a 20 tax that will be applied to C corporations taxable income. Keep in mind that this is not a self-imposed tax. IRM 48821 Accumulated Earnings Tax discusses that the burden of proof is on the Commissioner unless a notification is sent to the taxpayer under IRC 534 b.

If the accumulated earnings tax applies interest applies. A Personal Services Company PSC can make profits of up to 150000 without having to pay these fees.

Demystifying Irc Section 965 Math The Cpa Journal

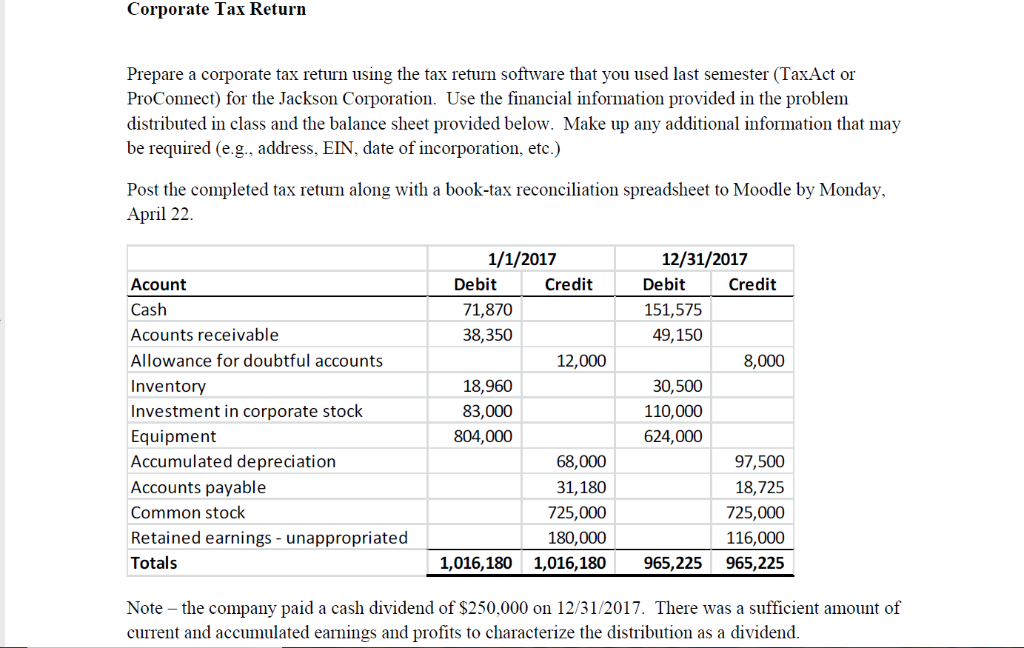

Corporate Tax Retur Prepare A Corporate Tax Return Chegg Com

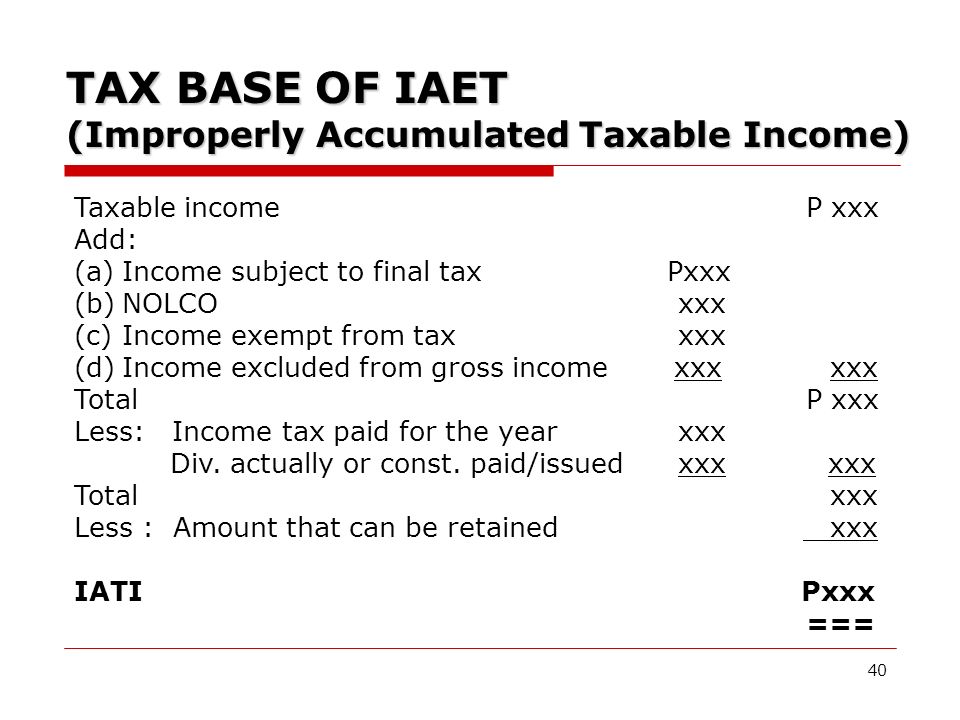

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

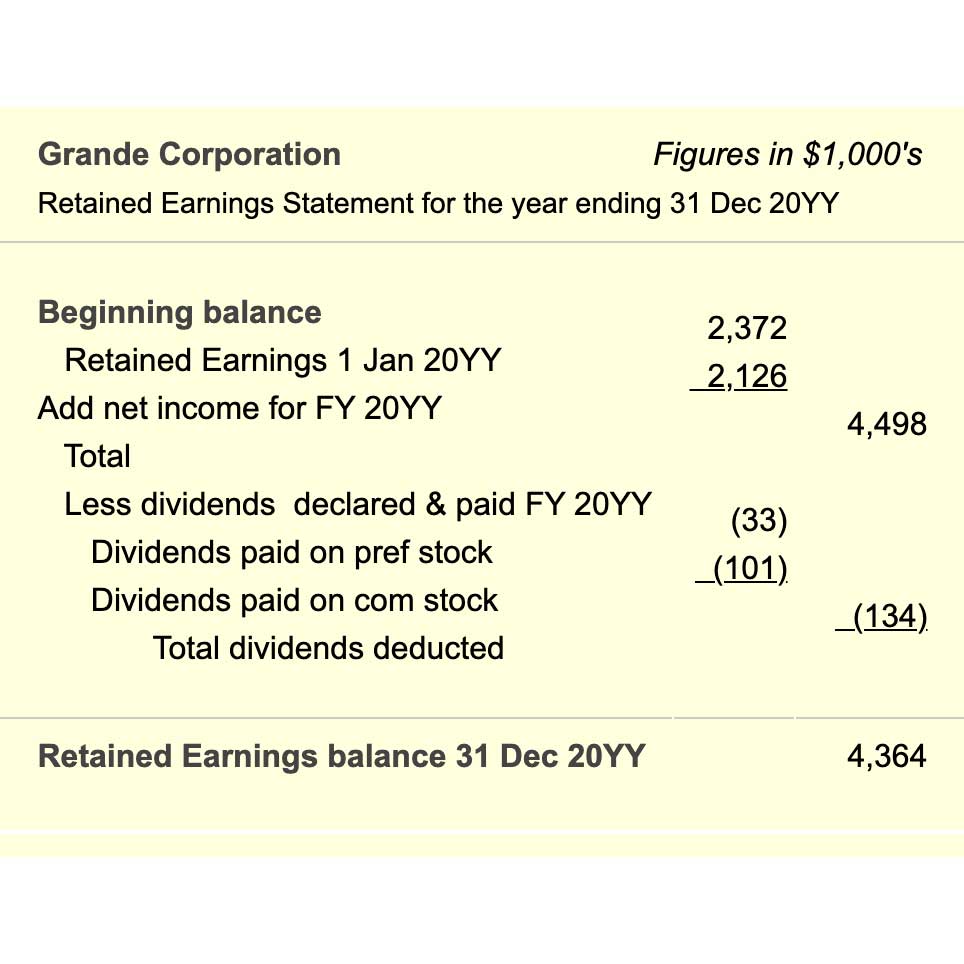

How Directors Use Shareholder Dividends To Build Owner Value

What Are Earnings After Tax Bdc Ca

S Corp Rias Disadvantaged By The Tax Bill Mercer Capital

Oh How The Tables May Turn C To S Conversion Considerations Stout

Earnings And Profits Computation Case Study

Compare And Contrast Owners Equity Versus Retained Earnings Principles Of Accounting Volume 1 Financial Accounting

Income Tax Computation For Corporate Taxpayers Prepared By

Is Corporate Income Double Taxed Tax Policy Center

Retained Earnings Account Is Missing

Earnings And Profits Computation Case Study

Earnings And Profits Computation Case Study

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Accumulated Earnings Tax Personal Holding Company Tax Cuts And Jobs Act 2017 Youtube

How Corporations May Run Afoul Of The Accumulated Earnings Tax A Section 1202 Planning Brief Frost Brown Todd Full Service Law Firm